Table of Contents:

- 1 Introduction

- 2 What is Scalping?

- 3 The Core Elements of a Profitable Scalping Strategy

- 4 Maximizing Profits with the Profitable Scalping Strategy

- 5 Conclusion

Introduction

As a forex trader, you’re likely always looking for new, effective strategies to increase profitability. One such approach that has gained significant traction among traders is the profitable scalping strategy. In this comprehensive guide, we’ll explore the ins and outs of this exciting trading method and provide you with actionable steps to master the art of scalping for consistent profits.

What is Scalping?

Scalping is a short-term trading strategy that involves entering and exiting trades within minutes or even seconds. The primary goal of a scalper is to capture small price movements and accumulate profits over multiple trades. Due to the fast-paced nature of this strategy, scalpers often rely on technical analysis, using various indicators and tools to identify entry and exit points.

The Core Elements of a Profitable Scalping Strategy

There are several essential elements you need to consider and incorporate into your trading plan to ensure that your scalping strategy is truly profitable. Some of these core elements are:

A Solid Trading Plan

A well-defined trading plan is the backbone of any profitable scalping strategy. This plan should outline the specific entry and exit rules, risk management guidelines, and preferred trading instruments. Sticking to your plan and maintaining discipline in executing your trades to achieve consistent profitability is essential.

Effective Trade Execution

Since scalping involves capturing small price movements, efficient trade execution is crucial. You must ensure that your trades are executed quickly and accurately to capitalize on short-lived opportunities. Choose a reliable trading platform and a broker that offers low latency, tight spreads, and fast order execution.

Proper Risk Management

Risk management is a critical component of any trading strategy, but it’s even more crucial in scalping due to its high-frequency trading nature. Ensure you set appropriate stop losses, practice position sizing, and maintain a favorable risk-to-reward ratio to protect your trading capital.

Maximizing Profits with the Profitable Scalping Strategy

To make the most of your profitable scalping strategy, consider incorporating the following tips into your trading routine:

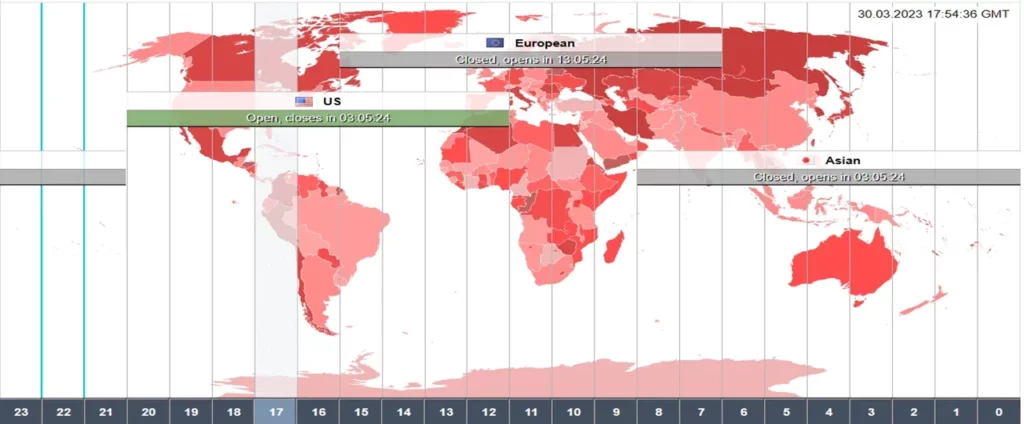

Trade During Peak Market Hours

Trading during peak market hours is key to maximizing profits with the profitable scalping strategy. This is because peak hours typically offer the highest liquidity and volatility essential for successful scalping.

Liquidity

In financial markets, liquidity refers to the ease with which an asset can be bought or sold without causing a significant change in its price. During peak market hours, a higher trading volume results in a more liquid market. This increased liquidity enables scalpers to enter and exit positions quickly, minimizing the impact of slippage (the difference between the expected price and the actual execution price).

Volatility

Volatility measures the degree of price fluctuations in a market. Scalpers thrive on price volatility, as it provides numerous short-term trading opportunities. Peak market hours usually coincide with significant news releases, economic data announcements, or market openings, which can lead to sudden and substantial price movements. Scalpers can capitalize on these price swings by executing multiple trades within a short time frame.

To maximize profits, scalpers should focus on trading during the most active sessions for their chosen market. For example, the Forex market is known to be most volatile during the overlap of the London and New York sessions. By targeting peak market hours, scalpers can take advantage of increased liquidity and volatility, enhancing their chances of generating profits from short-term price fluctuations.

Choose the Right Currency Pairs

Selecting the right currency pairs is crucial for maximizing profits with the profitable scalping strategy. The ideal currency pairs for scalping should have high liquidity, low spreads, and exhibit sufficient volatility to provide ample trading opportunities. Here’s a breakdown of the factors to consider when choosing the right currency pairs for scalping:

High Liquidity

Currency pairs with high liquidity tend to have tighter bid-ask spreads, meaning the difference between the buying and selling prices is minimal. This is essential for scalpers, as they aim to profit from small price movements and lower transaction costs.

Low Spreads

As mentioned earlier, the spread is the difference between a currency pair’s bid and ask prices. Since scalpers enter and exit numerous trades quickly, paying lower spreads is crucial to enhance profitability. Major currency pairs, such as EUR/USD, GBP/USD, and USD/JPY, usually have the lowest spreads due to their high liquidity.

Sufficient Volatility

While major currency pairs often offer sufficient volatility, certain minor or exotic pairs can also provide lucrative opportunities during specific market hours or events.

Correlation and Diversification

Understanding the correlation between different currency pairs is also important. Pairs that are positively correlated tend to move in the same direction, while negatively correlated pairs move in opposite directions. By trading a mix of correlated and non-correlated pairs, scalpers can diversify their risk exposure and potentially increase their chances of success.

So, scalpers should focus on trading highly liquid currency pairs with low spreads and sufficient volatility. Major currency pairs typically meet these criteria, but opportunities can also be found in select minor or exotic pairs. Additionally, considering correlation and diversification can help scalpers manage risk and improve their overall performance.

Utilize Multiple Timeframes

Utilizing multiple timeframes is a crucial component of the profitable scalping strategy, as it helps traders better understand the market context and confirm trade setups. Here’s a detailed explanation of how to use multiple timeframes in your scalping strategy:

Determine Your Trading Timeframes

As a scalper, you must decide on a primary and higher trading timeframe to analyze the broader market context. Generally, scalpers use 1-minute, 5-minute, or 15-minute charts as their primary trading timeframe. The higher timeframes, such as the 30-minute, 1-hour, and 4-hour charts, provide context for the overall market trend and key support and resistance levels.

Analyze the Higher Timeframes

Start by examining the higher timeframes to identify the prevailing market trend and key support and resistance levels. These levels can be potential entry and exit points for your scalping trades. Monitor major trend lines, moving averages, and Fibonacci retracement levels.

Identify Trade Setups on Your Primary Trading Timeframe

Once you understand the market context from the higher timeframes, look for trade setups in your primary trading timeframe. These setups might include price action patterns, such as candlestick formations, or technical indicators, like moving average crossovers or RSI divergences.

Confirm Trade Setups Across Timeframes

When you spot a potential trade setup on your primary trading timeframe, confirm its validity by checking for confluence with the higher timeframes. For example, if you see a bullish reversal pattern on the 5-minute chart, it would be more reliable if it occurs near a key support level or in line with the overall trend identified on the higher timeframes.

Manage Risk and Position Sizing

Appropriately managing your risk is important when trading across multiple timeframes. Use stop-loss orders to protect your capital and adjust your position size based on the volatility of the market and the distance to your stop-loss level. This ensures you maintain a consistent risk level across all trades, regardless of the timeframe.

Monitor and Adjust Your Analysis

Monitor the market and adjust your analysis as needed. Keep an eye on your higher timeframes to stay informed about any changes in the overall market trend or key support and resistance levels. If the market context changes, be prepared to adapt your scalping strategy accordingly.

Using multiple timeframes, you can maximize your profits with the profitable scalping strategy. This approach provides a more comprehensive market view, allowing you to effectively confirm trade setups, manage risk, and adapt to changing market conditions.

Keep an Eye on Economic News

Attention to economic news is essential to the profitable scalping strategy, as it helps you stay informed about market-moving events and manage your trades accordingly. Here’s a detailed explanation of how to effectively monitor economic news when using a scalping strategy:

Familiarize Yourself with Key Economic Indicators

As a scalper, you need to be aware of the economic indicators that have the potential to cause significant market volatility. Some examples include employment data, inflation figures, central bank interest rate decisions, and GDP growth. Understanding the impact of these indicators on the market will help you prepare for potential price movements.

Create an Economic Calendar

An economic calendar is a valuable tool for keeping track of important economic events and data releases. Many financial websites and trading platforms provide customizable economic calendars that allow you to filter events by country, currency, and importance. Set up your calendar to focus on the most relevant events to the markets and instruments you’re trading.

Monitor Real-Time News Sources

In addition to economic indicators, market-moving news includes geopolitical events, natural disasters, or major corporate announcements. Subscribe to real-time news feeds and alerts from reputable financial news sources to stay informed. This will help you stay current on unexpected events affecting your trades.

Plan Your Trading Sessions around News Events

When you’re aware of upcoming news events, you can plan your trading sessions accordingly. Some scalpers avoid trading during high-impact news releases, as the increased market volatility can lead to significant price spikes and potential losses. Alternatively, experienced scalpers may exploit the increased volatility to capture quick profits. Regardless of your approach, knowing when news events are scheduled can help you manage your trades more effectively.

Adjust Your Risk Management Strategy

During periods of increased market volatility, adjusting your risk management strategy is important to account for the potential for larger price movements. This may involve tightening your stop-loss orders, reducing your position size, or being more selective with your trade setups. By managing your risk carefully, you can protect your capital and maintain a consistent trading performance.

Evaluate the impact of news on your trades: After a news event, take the time to evaluate its impact on your trades and the market. Assess whether your analysis and expectations were accurate, and use this information to refine your future trading decisions. Learning from your experiences can help you become a more skilled and profitable scalper.

With the profitable scalping strategy, you can maximize your profits by watching economic news. Staying informed about market-moving events allows you to make better trading decisions, manage your risk more effectively, and adapt your strategy to changing market conditions.

Conclusion

In conclusion, mastering the art of profitable scalping requires dedication, discipline, and a deep understanding of the intricacies involved in this fast-paced trading strategy. By carefully selecting your trading platform, implementing a robust risk management system, and honing your technical analysis skills, you will be well on your way to becoming a successful scalper. Remember, practice makes perfect, so be bold and continually refine and evolve your approach to stay ahead of the game. Armed with the knowledge and insights from this comprehensive guide, you are now ready to embark on your journey to scalping success and reap the financial rewards that come with it.