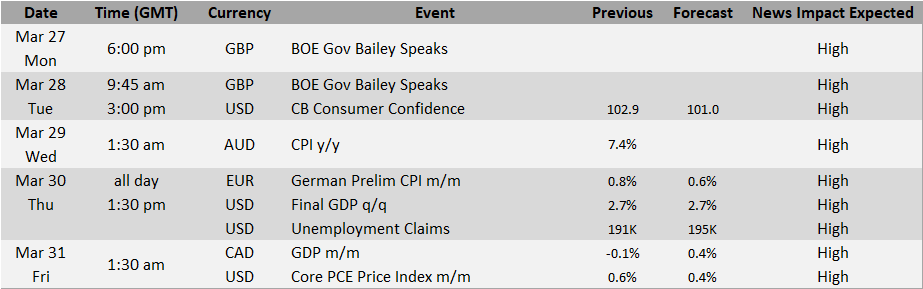

Forex News Events are crucial factors that can significantly impact the forex market, and traders need to keep themselves updated to make informed trading decisions. Several key news events may affect the forex market between Mar 27 (Monday) and Mar 31 (Friday). These include the release of the US Consumer Confidence Index, US Initial Jobless Claims, and the final GDP figures of the Eurozone. The Bank of Canada and Japan will also announce their latest interest rate decisions during this period. As these events have the potential to impact the value of currencies, traders should stay informed and be prepared to adjust their trading strategies accordingly.

Date: Mon, Mar 27 & Tue, Mar 28

Currency Behavior Analysis: GBP

News: BOE Gov Bailey Speaks

Analysis:

Bank of England (BOE) Governor Bailey’s speech can impact the Euro (EUR) in multiple ways, depending on the content and tone of his remarks. Suppose his comments suggest optimism about the UK economy or hint at tightening monetary policy in the future. This could lead to a stronger British Pound (GBP), which may put downward pressure on the Euro.

On the other hand, if Governor Bailey’s comments are perceived as dovish, suggesting a more accommodative monetary policy or expressing concerns about the UK’s economic outlook, this could weaken the GBP, potentially leading to a stronger Euro.

————————————————————

Date: Tue, Mar 28

Currency Behavior Analysis: USD

News: CB Consumer Confidence

Forecast: 101.0

Previous: 102.9

The Conference Board (CB) Consumer Confidence Index is an indicator that measures the level of consumer confidence in the US economy. The index is based on a survey of 5,000 households, asking respondents about their views on current business and employment conditions and their expectations for the next six months.

In this case, the forecasted CB Consumer Confidence Index is 101.0, lower than the previous reading of 102.9. This indicates that consumers are expected to be less optimistic about the state of the economy and prospects.

Table of Contents:

Impact on USD:

When consumer confidence decreases, it often implies that consumers are less likely to spend, which could lead to slower economic growth. A lower-than-expected Consumer Confidence Index reading can negatively affect the US Dollar (USD), indicating that the economy is not performing as well as previously anticipated.

A decrease in the Consumer Confidence Index may hurt the USD. It’s crucial to take a comprehensive look at other economic indicators and factors to understand the overall behavior of the currency better.

————————————————————

Date: Wed, Mar 29

Currency Behavior Analysis: AUD

News: CPI y/y (Consumer Price Index year-over-year)

Previous: 7.4%

The Consumer Price Index (CPI) measures inflation, reflecting the change in the cost of a fixed basket of goods and services over time. The year-over-year (y/y) figure represents the percentage change in the CPI compared to the same period in the previous year.

Impact on AUD:

An increase in the CPI y/y generally signals that inflation is rising, which can affect a country’s currency. Central banks like the Reserve Bank of Australia (RBA) closely monitor inflation levels to maintain price stability and influence economic growth.

Higher inflation can lead to the central bank raising interest rates to curb inflationary pressures. If the RBA were to increase interest rates, it could make the Australian Dollar (AUD) more attractive to investors, resulting in an appreciation of the currency. However, if inflation rises too rapidly, it could lead to concerns about economic stability and potentially harm the AUD’s value.

A 7.4% increase in the CPI y/y can have positive and negative implications for the AUD, depending on the context and other economic indicators.

————————————————————

Date: Thu, Mar 30

Currency Behavior Analysis: EUR

News: German Prelim CPI m/m

Forecast: 0.6%

Previous: 0.8%

The German Preliminary Consumer Price Index (CPI) measures the change in the cost of a fixed basket of goods and services in Germany month-over-month. In this case, the forecasted German CPI m/m is 0.6%, lower than the previous reading of 0.8%.

Impact on EUR:

Germany is the largest economy in the Eurozone, and its economic indicators often significantly impact the Euro (EUR). A lower CPI m/m forecast for Germany suggests that the inflation rate is expected to slow down compared to the previous month. This could indicate that the cost of living is stabilizing or demand for goods and services are decreasing.

A slower pace of inflation can have mixed implications for the EUR. On the one hand, if inflation remains within the European Central Bank’s (ECB) target range, the ECB may maintain its current monetary policy, which could provide stability for the EUR. On the other hand, if the lower inflation rate reflects a weakening demand for goods and services, it may signal concerns about the health of the German economy, potentially putting downward pressure on the EUR.

It’s crucial to consider other factors and economic indicators before determining the potential impact on the EUR. For instance, changes in interest rates, GDP growth, employment data, and other Eurozone countries’ economic performance can influence the currency’s behavior. Additionally, global economic conditions and geopolitical events can also affect the value of the EUR.

A decrease in the German CPI m/m may have mixed effects on the EUR, depending on the context and other economic indicators.

————————————————————

Date: Thu, Mar 30

Currency Behavior Analysis: USD

News1: Final GDP q/q (Gross Domestic Product quarter-over-quarter)

Forecast: 2.7%

Previous: 2.7%

News2: Unemployment Claims

Forecast: 195K

Previous: 191K

The final GDP q/q represents the last of three GDP estimates released for a specific quarter and reflects the change in the value of all goods and services produced by the US economy during that period. In this case, the forecast is 2.7%, which is unchanged from the previous estimate.

Unemployment claims represent the number of individuals who have filed for unemployment benefits for the first time during a week. The forecasted unemployment claims are 195K, slightly higher than the previous figure of 191K.

Impact on USD:

Final GDP q/q: An unchanged GDP forecast of 2.7% suggests that the US economy is growing moderately. This stable growth rate can be positive for the US Dollar (USD), indicating a healthy economic environment. However, since the forecast is the same as the previous figure, the impact on the USD may be limited, as it does not represent a significant change in market expectations.

Unemployment Claims: An increase in unemployment claims from 191K to 195K implies that more people are filing for unemployment benefits, potentially reflecting a slight weakening in the labor market. A higher number of unemployment claims could put downward pressure on the USD, as it may signal concerns about the health of the job market and its potential impact on consumer spending and overall economic growth.

The stable GDP forecast and the slight increase in unemployment claims may have mixed effects on the USD.

————————————————————

Date: Fri, Mar 31

Currency Behavior Analysis: CAD

News: Gross Domestic Product (GDP) month-over-month (m/m)

Forecast: 0.4%

Previous: -0.1%

The Canadian Dollar (CAD) is expected to react to the news of the Gross Domestic Product (GDP) month-over-month (m/m) data release. The forecast shows an improvement in GDP growth at 0.4%, compared to the previous month’s decline of -0.1%.

When the GDP growth rate improves, it reflects a stronger economy, suggesting increased production and spending. As a result, this could positively impact the CAD, causing it to appreciate against other currencies.

The forecasted 0.4% GDP growth might positively impact the Canadian Dollar.

————————————————————

Currency Behavior Analysis: USD

News: Gross Domestic Product (GDP) month-over-month (m/m)

Forecast: 0.4%

Previous: -0.1%

The Core PCE Price Index (Personal Consumption Expenditures) is a key indicator of inflation in the United States. It measures the change in the price of goods and services purchased by consumers, excluding food and energy. The Federal Reserve closely monitors this index when determining monetary policy, aiming to maintain price stability and manage inflation.

In this case, the Core PCE Price Index m/m forecast is 0.4%, lower than the previous reading of 0.6%. This suggests that market participants expect a slowdown in inflation for the period under consideration.

Implications for the USD

If the actual data meets or exceeds the forecast (0.4%), the USD might experience a positive impact. This is because a slowdown in inflation, while still showing growth, may signal that the economy is growing at a manageable pace. This may allow the Federal Reserve to maintain or tighten its monetary policy, leading to higher interest rates and a stronger USD.

The USD might weaken if the actual data is lower than the forecast. A lower-than-expected Core PCE Price Index might indicate that the economy is growing slower than anticipated or that there is a lack of demand. This could prompt the Federal Reserve to maintain or loosen its monetary policy, resulting in lower interest rates and a weaker USD.

The USD might face mixed reactions if the data exceeds the forecast. A higher-than-expected Core PCE Price Index might signal that inflation is growing faster than anticipated. While this could lead to the Federal Reserve tightening its monetary policy and raising interest rates (which would generally strengthen the USD), concerns over the pace of inflation could also prompt investors to seek safer assets or other currencies, leading to a potential weakening of the USD.

The Core PCE Price Index m/m data can have varying impacts on the USD, depending on the actual results compared to the forecast. Traders and investors should monitor the release of this data closely to gauge its potential impact on the USD and make informed decisions accordingly.

————————————————————

News Events Impact on USD/CAD currency pair

When analyzing the impact of news events on the USD/CAD currency pair, it is important to consider the data releases for both the US and Canada and their potential effects on each currency. Today’s news events are the Canadian GDP m/m and the US Core PCE Price Index m/m.

Canadian GDP m/m: The forecast for the Canadian GDP m/m is 0.4%, an improvement from the previous reading of -0.1%. Positive GDP growth signifies economic expansion and can be supportive of CAD. If the actual data meets or exceeds the forecast, it would indicate a strengthening Canadian economy and could lead to a stronger CAD.

US Core PCE Price Index m/m: As previously discussed, the forecast for the US Core PCE Price Index m/m is 0.4%, lower than the previous reading of 0.6%. Depending on the actual data release, the impact on the USD can vary, with potential outcomes including a stronger, weaker, or mixed reaction.

The combined impact of both news events on the USD/CAD currency pair can be summarized as follows:

- If the Canadian GDP m/m and US Core PCE Price Index m/m meet or exceed their respective forecasts, the CAD might strengthen due to positive economic growth, while the USD reaction could be mixed. In this scenario, the USD/CAD pair may experience downward pressure as the CAD strengthens relative to the USD.

- If the Canadian GDP m/m data is lower than the forecast, the CAD might weaken due to slower economic growth. If the US Core PCE Price Index m/m meets or exceeds the forecast, the USD might experience a positive impact. In this case, the USD/CAD pair could move upward as the USD strengthens relative to the CAD.

- If the Canadian GDP m/m data meets or exceeds the forecast and the US Core PCE Price Index m/m is lower than the forecast, the CAD might strengthen, while the USD might weaken. This scenario could lead to a significant downward movement in the USD/CAD pair.

- If both the Canadian GDP m/m and US Core PCE Price Index m/m data are lower than their respective forecasts, both currencies might experience weakness. However, the relative impact on each currency would depend on the degree to which the data deviates from the forecasts. In this case, the movement of the USD/CAD pair would depend on which currency is perceived as weaker by market participants.

Traders should closely monitor the actual data releases and consider the potential impact of each news event on the USD/CAD currency pair to make informed trading decisions.