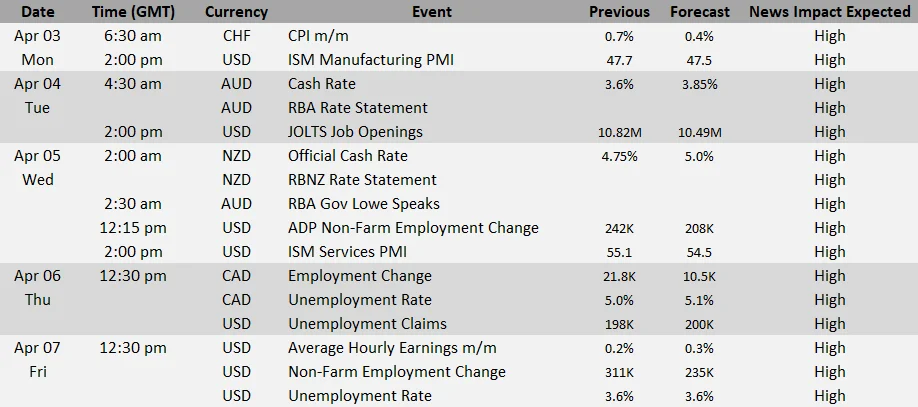

Forex news events are expected to dominate the market from April 3, 2023 (Mon) to April 7, 2023 (Fri), as traders and investors closely watch for significant economic indicators and events that can impact currency pairs. The upcoming week will witness several important events, such as the RBA interest rate decision and monetary policy statement, the FOMC meeting minutes, and the release of US employment data, including the Non-Farm Payrolls report. Moreover, important economic data releases from Canada, the Eurozone, Australia, and New Zealand are scheduled, which will also influence the forex market. Traders and investors must stay abreast of the latest news and developments to make informed decisions in these highly volatile times.

Date: Mon, April 3

Currency Behavior Analysis: CHF

News: CPI m/m

Forecast: 0.4%

Previous: 0.7%

If the CHF CPI m/m (Consumer Price Index month-over-month) figure is released as per the forecast value of 0.4%, it will likely have a moderate impact on CHF currency pairs.

Since the forecasted value is lower than the previous figure of 0.7%, the inflation rate has slowed in Switzerland, potentially leading to a decrease in the value of CHF currency pairs. However, this news’s impact depends on various factors influencing the market.

————————————————————

Date: Mon, Tue 3

Currency Behavior Analysis: USD

News: ISM Manufacturing PMI

Forecast: 47.5

Previous: 47.7

If the USD ISM Manufacturing PMI (Institute for Supply Management Manufacturing Purchasing Managers’ Index) figure is released as the forecast value of 47.5, it could hurt USD currency pairs.

The ISM Manufacturing PMI is an important indicator of the health of the US manufacturing sector. A figure below 50 indicates a contraction in the sector, while a figure above 50 indicates an expansion. If the figure comes in as per the forecasted value of 47.5, the US manufacturing sector is contracting slightly faster than the previous month.

This could lead to a decrease in demand for USD currency pairs, as a weaker manufacturing sector is generally seen as a negative sign for the overall health of the US economy. However, the extent of the impact on the market would depend on various other factors, such as the market sentiment at the time of the release, the state of the global economy, and other economic events happening simultaneously.

————————————————————

Date: Tue, April 4

Currency Behavior Analysis: AUD

News: Cash Rate

Forecast: 3.85%

Previous: 3.60%

If the AUD Cash Rate (Interest Rate) figure is released as per the forecasted value of 3.85%, it could positively impact AUD currency pairs. A higher cash rate is generally seen as a sign of a stronger economy, implying that the central bank is trying to control inflation and maintain stable economic growth.

This could lead to increased demand for AUD currency pairs, as investors may be attracted by the higher interest rates offered by the Australian market. However, the extent of the impact on the market would depend on various other factors, such as the market sentiment at the time of the release, the state of the global economy, and other economic events happening simultaneously.

Furthermore, central banks often give forward guidance on their future monetary policy decisions. If the Reserve Bank of Australia (RBA) maintains a hawkish tone and indicates that it plans to continue raising interest rates, it could lead to a more significant positive impact on AUD currency pairs.

————————————————————

Date: Tue, April 4

Currency Behavior Analysis: AUD

News: RBA Rate Statement

The RBA Rate Statement is an important economic event that can significantly impact AUD currency pairs. If the RBA Rate Statement suggests that the central bank plans to maintain its current interest rate policy, it could lead to a relatively muted response from the market, as investors have likely priced in this expectation already.

However, if the RBA signals that it plans to raise interest rates shortly, it could lead to bullish sentiment on AUD currency pairs. Higher interest rates often attract foreign investment, increasing demand for the AUD and its value.

On the other hand, if the RBA indicates that it plans to lower interest rates, it could lead to a bearish sentiment on AUD currency pairs. Lower interest rates can decrease foreign investment in the Australian economy, decreasing demand for the AUD and potentially driving down its value.

The extent of the impact on AUD currency pairs would depend on various other factors, such as the market sentiment at the time of the release, the state of the global economy, and other economic events happening simultaneously. Additionally, the market may react differently based on the language used in the RBA Rate Statement and the central bank’s forward guidance on future monetary policy decisions.

————————————————————

Date: Tue, April 4

Currency Behavior Analysis: USD

News: JOLTS Job Openings

Forecast: 10.49M

Previous: 10.82M

If the USD JOLTS Job Openings figure is released as per the forecasted value of 10.49M, it could hurt USD currency pairs.

The Job Openings and Labor Turnover Survey (JOLTS) measures the number of job openings in the US economy and is an important indicator of the health of the labor market. If the figure comes in lower than the previous month’s figure of 10.82M, it suggests fewer job openings in the US economy.

This could lead to decreased demand for USD currency pairs, as investors may interpret the lower job openings as a sign of a weaker economy. However, the extent of the impact on the market would depend on various other factors, such as the market sentiment at the time of the release, the state of the global economy, and other economic events happening simultaneously.

Moreover, the JOLTS report contains other data on hiring, quits, and layoffs, which can also affect the market’s reaction to the release. If the report shows an increase in hiring or a decrease in layoffs, it could offset the negative impact of the lower job openings figure and lead to a more muted response from the market.

————————————————————

Date: Wed, April 5

Currency Behavior Analysis: NZD

News: Official Cash Rate

Forecast: 5.00%

Previous: 4.75%

If the Official Cash Rate (OCR) forecast for NZD is released at 5.00%, as expected, there is no change in the interest rate from the previous value of 4.75%. In such a scenario, the impact on NZD currency pairs will likely be muted as the market has already priced in this expected outcome.

Traders and investors will focus on the accompanying statement from the Reserve Bank of New Zealand (RBNZ) to gauge the central bank’s future monetary policy stance. Any hints or signals of a potential rate hike may lead to a bullish sentiment towards the NZD currency pairs, while any dovish signals may lead to a bearish sentiment.

————————————————————

Date: Wed, April 5

Currency Behavior Analysis: NZD

News: RBNZ Rate Statement

The Reserve Bank of New Zealand (RBNZ) rate statement is an important event for the NZD currency pairs, as it outlines the central bank’s current and future monetary policy stance. The news impact on NZD currency pairs can be significant if the statement contains unexpected changes in the RBNZ’s policy outlook.

If the RBNZ rate statement signals that the central bank is considering or planning to raise interest rates, this is likely a bullish signal for the NZD currency pairs. The anticipation of higher interest rates can attract investors to buy the NZD, increasing the currency’s value.

On the other hand, if the RBNZ rate statement indicates that the central bank is planning to keep interest rates low or cut them further, this is likely to be viewed as a bearish signal for the NZD currency pairs. Lower interest rates can make the currency less attractive to investors, leading to a decrease in the currency’s value.

It’s important to note that the market’s reaction to the RBNZ rate statement can also depend on how closely it aligns with market expectations. If the statement matches the market’s expectations, the news impact on NZD currency pairs may be muted. However, if the statement deviates significantly from market expectations, the impact on NZD currency pairs can be more pronounced.

————————————————————

Date: Wed, April 5

Currency Behavior Analysis: AUD

News: RBA Gov Lowe Speaks

When the Governor of the Reserve Bank of Australia (RBA), Dr. Philip Lowe, speaks, it can significantly impact the AUD currency pairs. Governor Lowe’s speeches can provide insights into the RBA’s current and future monetary policy stance and its assessment of domestic and global economic conditions. Here’s how his speech can impact AUD currency pairs:

Hawkish signals: If Governor Lowe’s speech indicates that the RBA is considering raising interest rates or tightening its monetary policy, this can be viewed as a bullish signal for the AUD currency pairs. The anticipation of higher interest rates can attract investors to buy the AUD, increasing the currency’s value.

Dovish signals: If Governor Lowe’s speech indicates that the RBA is considering cutting interest rates or loosening its monetary policy, this can be viewed as a bearish signal for the AUD currency pairs. Lower interest rates can make the currency less attractive to investors, leading to a decrease in the currency’s value.

Economic assessment: Governor Lowe’s speech may provide insights into the RBA’s domestic and global economic conditions assessment. If his assessment is positive, it can be viewed as a bullish signal for the AUD currency pairs, while a negative assessment can be viewed as a bearish signal.

Market expectations: The market’s reaction to Governor Lowe’s speech can also depend on how closely his comments align with market expectations. If his comments match the market’s expectations, the news impact on AUD currency pairs may be muted. However, if his comments deviate significantly from market expectations, the impact on AUD currency pairs can be more pronounced.

————————————————————

Date: Wed, April 5

Currency Behavior Analysis: USD

News: ADP Non-Farm Employment Change

Forecast: 208K

Previous: 242K

If the ADP Non-Farm Employment Change forecast for USD is released at 208K, as expected, it means that the number of jobs added by the private sector in the US for the previous month is lower than the previous value of 242K. In such a scenario, the impact on USD currency pairs is likely negative as it can indicate a slowdown in the US labor market.

The market’s reaction to the ADP Non-Farm Employment Change release can depend on how closely the actual figure matches the forecast. If the actual figure aligns with the forecast, the news impact on USD currency pairs may be muted. However, if the actual figure deviates significantly from the forecast, the impact on USD currency pairs can be more pronounced.

————————————————————

Date: Wed, April 5

Currency Behavior Analysis: USD

News: ISM Services PMI

Forecast: 54.5

Previous: 55.1

If the ISM Services PMI forecast for USD is released at 54.5, as expected, the purchasing managers’ index for the US services sector has decreased slightly compared to the previous value of 55.1. In such a scenario, the impact on USD currency pairs is likely negative as it can indicate a slowdown in the US services sector.

The market’s reaction to the ISM Services PMI release can depend on how closely the actual figure matches the forecast. If the actual figure aligns with the forecast, the news impact on USD currency pairs may be muted. However, if the actual figure deviates significantly from the forecast, the impact on USD currency pairs can be more pronounced.

————————————————————

Date: Thu, April 6

Currency Behavior Analysis: CAD

News: Employment Change

Forecast: 10.5K

Previous: 21.8K

If the Employment Change forecast for CAD is released at 10.5K, as expected, the number of jobs added in Canada for the previous month has decreased compared to the previous value of 21.8K. In such a scenario, the impact on CAD currency pairs is likely negative as it can indicate a slowdown in the Canadian labor market.

The market’s reaction to the Employment Change release can depend on how closely the actual figure matches the forecast. If the actual figure aligns with the forecast, the news impact on CAD currency pairs may be muted. However, if the actual figure deviates significantly from the forecast, the impact on CAD currency pairs can be more pronounced.

————————————————————

Date: Thu, April 6

Currency Behavior Analysis: CAD

News: Unemployment Rate

Forecast: 5.1%

Previous: 5.0%

If the Unemployment Rate forecast for CAD is released at 5.1%, as expected, it means that the unemployment rate in Canada has increased slightly compared to the previous value of 5.0%. In such a scenario, the impact on CAD currency pairs is likely negative as it can indicate a weaker labor market and slower economic growth.

The market’s reaction to the Unemployment Rate release can depend on how closely the actual figure matches the forecast. If the actual figure aligns with the forecast, the news impact on CAD currency pairs may be muted. However, if the actual figure deviates significantly from the forecast, the impact on CAD currency pairs can be more pronounced.

————————————————————

Date: Thu, April 6

Currency Behavior Analysis: USD

News: Unemployment Claims

Forecast: 200K

Previous: 198K

Suppose the Unemployment Claims forecast for USD is released at 200K, as expected. In that case, the number of individuals filing for unemployment benefits in the US has increased slightly compared to the previous value of 198K. In such a scenario, the impact on USD currency pairs is likely negative as it can indicate a weaker labor market and slower economic growth.

The market’s reaction to the Unemployment Claims release can depend on how closely the actual figure matches the forecast. If the actual figure aligns with the forecast, the news impact on USD currency pairs may be muted. However, if the actual figure deviates significantly from the forecast, the impact on USD currency pairs can be more pronounced.

————————————————————

Date: Fri, April 7

Currency Behavior Analysis: USD

News: Average Hourly Earnings m/m

Forecast: 0.3%

Previous: 0.2%

Suppose the Average Hourly Earnings m/m forecast for USD is released at 0.3%, as expected. In that case, the average hourly wages in the US have increased slightly compared to the previous value of 0.2%. In such a scenario, the impact on USD currency pairs is likely positive as it can indicate stronger wage growth and a potential increase in consumer spending.

The market’s reaction to the Average Hourly Earnings release can depend on how closely the actual figure matches the forecast. If the actual figure aligns with the forecast, the news impact on USD currency pairs may be muted. However, if the actual figure deviates significantly from the forecast, the impact on USD currency pairs can be more pronounced.

————————————————————

Date: Fri, April 7

Currency Behavior Analysis: USD

News: Non-Farm Employment Change

Forecast: 235K

Previous: 311K

If the Non-Farm Employment Change forecast for USD is released at 235K, as expected, the number of jobs added to the US economy has decreased compared to the previous value of 311K. In such a scenario, the impact on USD currency pairs is likely negative as it can indicate a slowdown in the US labor market.

The market’s reaction to the Non-Farm Employment Change release can depend on how closely the actual figure matches the forecast. If the actual figure aligns with the forecast, the news impact on USD currency pairs may be muted. However, if the actual figure deviates significantly from the forecast, the impact on USD currency pairs can be more pronounced.

Traders and investors should also pay attention to the Unemployment Rate, which is released along with the Non-Farm Employment Change report. A decrease in the unemployment rate can be viewed as a positive signal for USD currency pairs, while an increase in the unemployment rate can be viewed as a negative signal.

————————————————————

Date: Fri, April 7

Currency Behavior Analysis: USD

News: Unemployment Rate

Forecast: 3.6%

Previous: 3.6%

If the Unemployment Rate forecast for USD is released at 3.6%, as expected, it means that the unemployment rate in the US remains unchanged from the previous value of 3.6%. In such a scenario, the impact on USD currency pairs will likely be muted as the market has already priced in this expected outcome.

However, traders and investors may still look at the Non-Farm Payrolls (NFP) report, which is released along with the Unemployment Rate, to gauge the strength of the US labor market. A higher-than-expected NFP figure can be viewed as a bullish signal for USD currency pairs, while a lower-than-expected figure can be a bearish signal.

Expert Analysis of USD Pairs

When multiple economic indicators are released simultaneously, as in the case of the USD news, forex traders need to assess the overall impact of the news on the USD currency pairs. Here are some ways forex traders can utilize this USD news for their currency trading:

Analyze the inter-relationship: Forex traders need to analyze the inter-relationship between the different economic indicators. For example, suppose the Non-Farm Employment Change is higher than expected, but the Average Hourly Earnings m/m is lower than expected. In that case, it can indicate an increase in jobs but a potential decrease in wage growth, which can impact the USD currency pairs differently.

Identify the market expectations: Forex traders need to identify the market expectations for each economic indicator and compare them to the actual figures. If the actual figures are better than expected, it can be viewed as a positive signal for the USD currency pairs, while a worse-than-expected outcome can be viewed as a negative signal.

Consider the impact on the US economy: Forex traders need to consider the impact of the economic indicators on the overall US economy. For example, suppose the Non-Farm Employment Change is higher than expected. In that case, it can indicate a stronger labor market, potentially leading to increased consumer spending and economic growth, which can be a positive signal for the USD currency pairs.

Assess the potential impact on monetary policy: Forex traders also need to assess the potential impact of the economic indicators on the Federal Reserve’s monetary policy stance. Stronger economic data can lead to an increase in interest rates, which can make the USD currency pairs more attractive to investors.